Filing a claim can be time-consuming and complicated. It’s important to get help.

Applications for Pension that involve a rating, evidence of prospective, recurring medical expenses, appointments for VA powers of attorney and fiduciaries, and an understanding of the actual application process should not be attempted without prior knowledge.

Applications that also involve reallocation of assets in order to qualify should not be attempted without the help of a qualified veterans aid and attendance benefit consultant.

Understanding VA Pension and VA Pension with Aid and Attendance

“Aid and attendance” is a commonly used term for a little-known veterans’ disability income. The official title of this benefit is “Pension.” The reason for using “aid and attendance” to refer to Pension is that many veterans or their single surviving spouses can become eligible if they have a regular need for the aid and attendance of a caregiver or if they are housebound.

Evidence of this need for care must be certified by VA as a “rating.” With a rating, certain veterans or their surviving spouses can now qualify for Pension. Pension is also available to low income veteran households without a rating, but it is a lesser dollar amount.

For information on ratings please go to the article entitled “Who is eligible for the aid and attendance Pension benefit?”

Pension Is One of Two Disability Income Benefits from VA

The Department of Veterans Affairs offers two disability income benefits for veterans who served on active duty.

The first of these benefits — Pension — is the subject of this website and is discussed briefly in a section above. The purpose of this benefit is to provide supplemental income to disabled or older veterans who have a low income. Pension is for war veterans who have disabilities that are not connected to their active-duty service.

If the veteran’s income exceeds the Pension amount, then there is no award. However, income can be adjusted for unreimbursed medical expenses, and this allows veterans with household incomes larger than the Pension amount to qualify for a monthly benefit. There is also an asset test to qualify for Pension.

The second disability income benefit is called “Compensation” and it is designed to award the veteran a certain amount of monthly income to compensate for potential loss of income in the private sector due to a disability or injury or illness incurred in the service. In order to receive Compensation, a veteran has to have evidence of a service-connected disability.

Most veterans who are receiving this benefit were awarded an amount based on a percentage of disability shortly after they left the service. There is generally no income or asset test for most forms of Compensation, and the benefit is nontaxable.

Some veterans may have record of being exposed to extreme cold, having an inservice, nondisabling injury, having tropical diseases or tuberculosis or other incidents or exposures that at the time may not have caused any disability but years later have resulted in medical problems.

Most elderly veterans who never applied for compensation, may not realize they can apply many years after leaving the service. In fact, VA recognizes this issue and in 2006 conducted an outreach program to these veterans in five selected states with low elderly Compensation enrollment and ended up adding an additional 8,000 beneficiaries to the roles.

Some veterans may be receiving Compensation but their condition has worsened. They can reapply and get a larger amount based on a higher disability rating. In fact, in 2007, VA expects twice as many cases of existing compensation to be reopened for new consideration as new first-time claims.

In 2007, VA anticipates 216,000 new claims for Compensation but will receive 448,000 claims for reconsideration of existing Compensation benefits.

Compensation and Pension claims are submitted on the same form and VA will consider paying either benefit. If a claimant is awarded both benefits, the claimant can only receive one of them. Generally, for applications associated with the cost of home care, assisted living or nursing home care, the Pension benefit results in more income.

Of the two benefits, Compensation provides 10 times more total income and covers 6 times more beneficiaries than Pension. In 2007, Compensation will pay 3,116,728 beneficiaries a total of $34,750,690,000 and Pension will pay 523,824 beneficiaries a total of $3,671,997,000.

Compensation is a rapidly growing program and VA estimates that approximately 35% of all veterans leaving the service will eventually submit a claim for Compensation benefits. Compensation is already a major government entitlement program and currently chews up 45% of the entire VA budget. In years to come, it will continue to become a larger proportion of the Veterans Affairs and federal budget.

We will devote little mention of Compensation benefits on this site. The application process is fairly clear and requires no additional knowledge to submit a claim. The balance of this site will be devoted almost exclusively to Pension since Pension fits very nicely with long term care costs.

There are also several death benefit variations of the two disability incomes for single surviving spouses or dependent minor children or adult dependent children. We will not discuss the death benefits related to service-connected disability but instead will discuss on this site only the Death Pension benefit.

Pension for Veterans with Low Income, Little Savings and Few Investments

Although the Veterans Administration does not differentiate between various Pension applicants, there are, in practice, two kinds of Pension applications. The first type of application or claim, as it’s called by VA, deals with veteran households that do not generally require the rating mentioned above in order to receive a benefit or as VA calls it, an award.

These applicants will have household income less than the monthly allowable Pension rate. In addition, they will have very little in savings or investments. And, with no ratings, the size of their Pension awards will be much smaller.

It is our opinion that most veterans or their surviving spouses, receiving Pension, are in this category. We believe this is true for several reasons. One reason is that Veterans Service Representatives in the local regional office, who deal with the public, will tell callers that Pension is only available to veteran households with low income. VSR’s turn away a lot of potential applicants.

This is probably because these employees are not trained sufficiently to understand the special case of veterans with higher income and high long term care costs. A second reason is that callers will be told — if they have significant savings or investments — they will not qualify as well. It is possible to give away assets in order to qualify for Pension.

Naturally, Veterans Service Representatives will not mention this as an option. A third reason is that veterans with higher income and significant assets generally don’t know they can qualify for Pension under certain conditions. No one has ever told them.

As a result, they never apply. A compelling fourth reason is that most people don’t know the aid and attendance Pension benefit (includes A&A allowance) can help cover home care costs paid to any person or professional providers. Most people don’t attempt to apply until they have become single and enter a nursing home where VA refuses to pay the benefit if the single claimant is eligible for Medicaid.

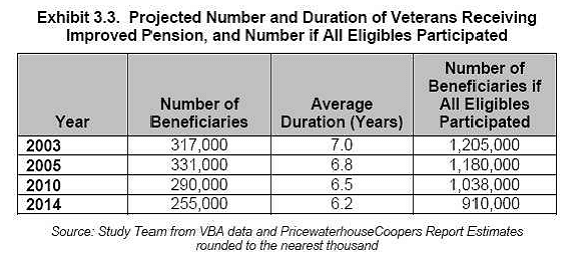

The table below, labeled “Exhibit 3.3,” is from a study conducted for VA to determine how many veterans might apply for Pension in coming years. The subjects of this report are most likely veterans with low household income and few assets.

This group would be included because it is easy to research their demographics in government statistical reports. Those veteran households with higher income and high long term care costs would not show up in this report because it is difficult to predict how many veteran households will actually need long term care and what those costs might be.

It is apparent from the report that only about 28% of the eligible veteran households will actually apply for and receive Pension over the next seven years. It also appears from the study, that even for those households where Pension naturally fits, VA is not doing a good job of educating potential beneficiaries about this benefit or more would be applying.

In fact, the 2008 federal operating budget projected by Veterans Affairs shows a decline in the number of people applying for Pension; whereas, based on the table below, the program should be serving more than 3 1/2 times as many people as it does now.

VA wants to get the word out and in January of 2007, VA Secretary Jim Nicholson issued a news release that was carried by many major papers about this benefit. State Veterans Affairs departments also want the public to know about Pension, but lacking advertising budgets, they are not very effective at letting people know.

The table below does not reflect the number of surviving spouses of eligible veterans or their dependent children who are also eligible for a lesser Pension benefit called “Death Pension.” In 2005, approximately 207,000 of these eligible beneficiaries were also receiving Death Pension payments from VA, in addition to the 331,000 estimated living veteran beneficiaries. Since the 2005 numbers are now available, the actual number of living veteran beneficiaries in 2005, receiving Pension, was 336,000.

The following was taken from a survey by ORC Macro Economic Systems Inc., Hay Group, December 22, 2004 called “VA Pension Program Final Report”

Pension for Veterans Who Require a Rating for “Aid And Attendance” or “Housebound” in Order to Receive an Award

This is the second type of VA application generally submitted for a claim. Claimants in this category often have income above the maximum Pension rate and they may also have significant savings or investments. Typically, this category of application requires a potential beneficiary to be paying for ongoing and expensive long term care or other medical costs.

For veteran households receiving expensive long term care services and whose incomes exceed maximum Pension rates, a rating is almost always necessary in order to receive a benefit. In most cases, without a rating, there is no benefit.

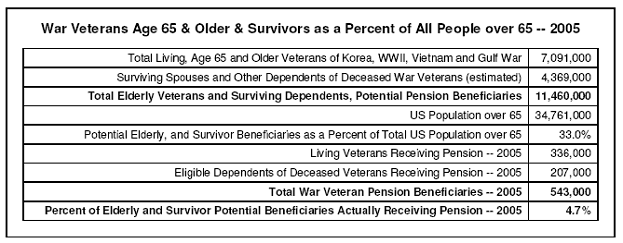

Because we believe the study above does not include an estimate for individuals requiring future VA disability ratings, we offer evidence that there is a significantly larger category of potential Pension beneficiaries.

This group of eligible veterans or their survivors is about 10 times larger than the one million or so anticipated eligible beneficiaries covered by the study and expected to be awarded over the next seven years. On the other hand, this larger group of roughly 10 million Pension beneficiaries can only receive an award under certain special conditions and typically only if they receive a rating.

Receipt of a Pension benefit for this larger group is generally dependent upon whether these people have a need for long term care services. But, based on the incidence of long term care in an older population, at least 60% to 80% of this larger group might have a good chance of qualifying for Pension sometime during their remaining years.

For an explanation of the special annualized treatment of unreimbursed long term care costs and insurance premiums please go to the article entitled “The special case of long term care medical costs.”

The table below examines this sizable group of potential beneficiaries and also compares them to the smaller group in “Exhibit 3.3” above. Estimates of the number of survivor beneficiaries in the table below were based on the percentage of that group actually receiving benefits over the number of living veterans actually receiving the benefit. Data for this table were taken from the 2007 Statistical Abstract of the United States for the most recent years of 2005.

What is surprising about these numbers is that a third of all people — 33% — in this country, over the age of 65, have a potential for receiving a Pension benefit. That’s how many war veterans or their survivors there are in the US.

The potential for receiving a benefit is huge. But, in actuality, only 4.7% of this large population of potential beneficiaries was actually receiving a benefit in 2005. This is truly astounding and appalling! Someone needs to do a much better job of getting the word out.

2020 Maximum Annual Veterans Pension Rates (MAPR)

Effective December 1, 2019 – 1.6% COLA Increase

| If you are a veteran | Annual | Monthly |

| Housebound Without Dependents | $16,805 | $1,400 |

| Housebound With One Dependent | $21,063 | $1,755 |

| A&A Without Dependents | $22,939 | $1,911 |

| A&A With One Dependent | $27,195 | $2,266 |

2020 Maximum Annual Survivors Pension Rates (MAPR)

Effective December 1, 2019 – 1.6% Annual Increase

| If you are a surviving spouse | Annual | Monthly |

| Housebound Without Dependents | $11,273 | $939 |

| Housebound With One Dependent | $14,116 | $1,176 |

| A&A Without Dependents | $14,742 | $1,228 |

| A&A With One Dependent | $17,586 | $1,465 |

2023 Aid & Attendance Award

| Annual | Monthly | |

| Married Veteran | $31,713 | $2,642 |

| Single Veteran | $26,751 | $2,229 |

| Surviving Spouse | $17,191 | $1,432 |

| Numbers show 8.7% COLA |

What years are considered wartime, in terms of qualifying for Aid and Attendance?

- World War I (April 6, 1917 – November 11, 1918)

- World War II (December 7, 1941 – December 31, 1946)

- Korean conflict (June 27, 1950 – January 31, 1955)

- Vietnam era (February 28, 1961 – May 7, 1975 for Veterans who served in the Republic of Vietnam during that period; otherwise August 5, 1964 – May 7, 1975)

For more information on applying for Pension, please call us at 858-673-8448 (ask for TONY).